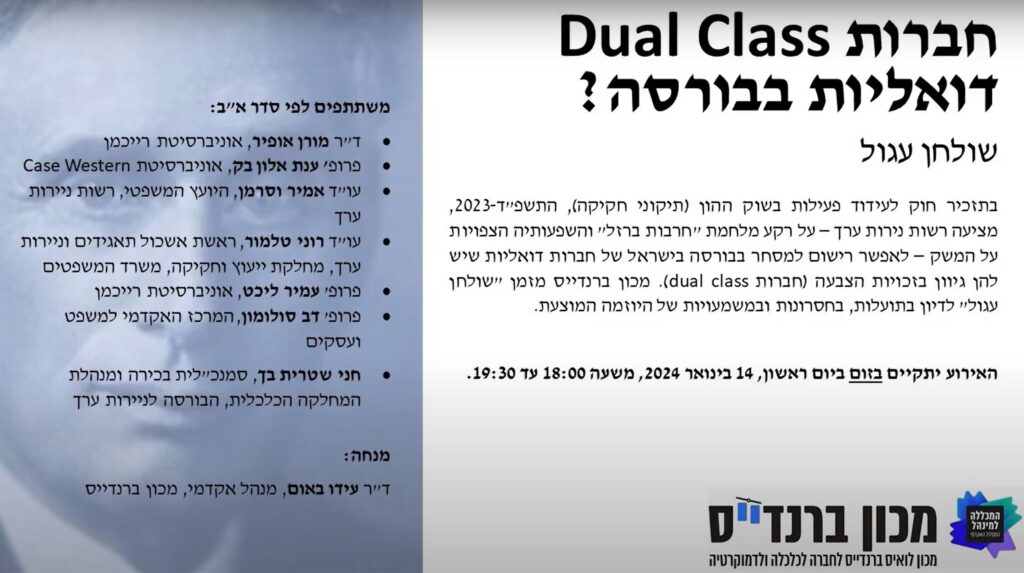

Dual Class Companies in the Israeli Market?

Is it desirable to allow dual class companies traded on recognized stock exchanges abroad to cross-list for trading on the Tel Aviv stock exchange?

This question was discussed in a roundtable event held by The Brandeis Institute on January 14, 2024, following a Law Memorandum published by the Securities Authority. The Memorandum includes a chapter concerning dual class companies, which are currently prohibited from trading on the Israeli stock exchange.

Section 46b of the Securities Law prevents the registration of dual class companies for trading on the stock exchange. The clause was enacted in the 1980s to minimize the representative problem that may arise from the gap between capital rights and control rights. However, the Memorandum is now proposing to allow an exception for dual class companies traded on “recognized” foreign exchanges (such as the New York Stock Exchange) to simultaneously list their shares for trading on the Israeli stock exchange. This would allow such companies to be traded as “dual listing” companies under foreign supervision, rather than the supervision of the Israeli authorities.

The round table discussion included the presentation of the Memorandum and the regulators’ agenda by the Securities Authority legal advisor, Adv. Amir Wasserman and the Head of Corporations and Securities Cluster at the Ministry of Justice, Adv. Roni Talmore. The stock exchange’s position and an economic viewpoint was presented by Hani Shitrit Bach, Senior Vice President and Director of the Economic Department of the Tel Aviv Stock Exchange.

Academic viewpoints were presented by Prof. Amir Licht (Reichman University), Prof. Anat Alon Beck (Case Western University), Prof. Dov Solomon (Academic Center for Law and Business), Dr. Moran Ofir (Reichman University), and Prof. Kobi Kastiel (Tel Aviv University). The discussion was moderated by Dr. Ido Baum, head of the Brandeis Institute.

The discussion (in Hebrew) is available below.